- By: News

- 0 comment

- Finance minister Tito Mboweni said the tax on fuel will increase by 25c a litre in 2020.

- The national Treasury believes that additional taxes will stifle growth, so increased the petrol tax in line with inflation instead.

- An environmental fiscal-reform paper will be released, on the possible restructure of the fuel levy to include a local air pollution emissions component.

- For more stories visit Business Insider South Africa.

The tax on one litre of petrol and diesel will increase by 25c in 2020, finance minister Tito Mboweni said during his Budget speech on Wednesday afternoon.

This as South Africa struggles with a budget shortfall of R370.5 billion.

Budget documents reveal that the national Treasury believes South Africans are already overburdened with tax, and that additional taxes to plug budget deficit would stifle economic growth – so existing taxes, including on fuel, will increase at roughly the rate of inflation instead.

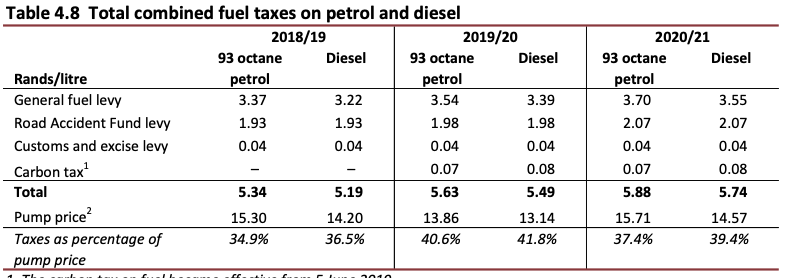

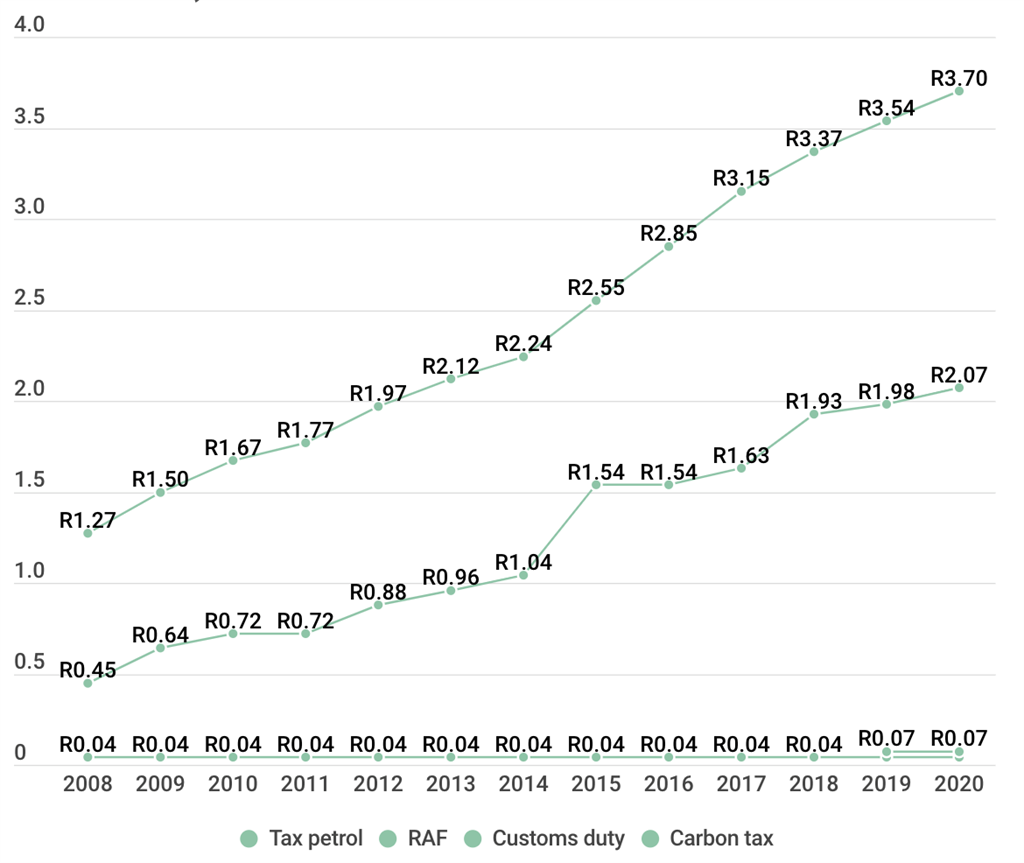

Mboweni said the fuel levy would increase by 16c and the levy for the nearly insolvent Road Accident Fund (RAF) – which the Treasury said is the state’s second-largest liability after Eskom – will increase by 9c from the beginning of April.

National Treasury officials said the carbon tax was reduced in 2019 from an originally envisioned 10c per litre to 7c per litre of petrol, and 8c on a litre of diesel, to more accurately reflect carbon content.

It said carbon tax will remain unchanged in 2020.

In total, South Africans will, from April, pay R5.88 in tax on each litre of fuel.

Taxes on fuel will now make up 37.4% of the price of a litre petrol (which costs R15.71 in Gauteng), and 39.4% of the price of a litre diesel (which costs R14.57 in Gauteng).

This is slightly lower than the 40.6% of the average petrol price for 2019 which went to taxes.

Overall, tax on fuel increased from R1.76 in 2008 to R5.88 in 2020 – a roughly 234% increase.

In budget documents, Treasury said the general fuel levy might be restructured to include a local air pollution emissions component, to be discussed in an upcoming environmental fiscal reform paper.

Other proposals will be considered with that paper at the base of the debate, including reviewing inefficient fossil fuel subsidies, taxes on electrical and electronic waste, and the tax treatment of company cars to incentivise use of more fuel-efficient vehicles, Treasury said.

https://www.businessinsider.co.za/youll-soon-pay-25c-more-tax-per-litre-of-fuel-heres-how-fuel-tax-increased-from-2008-2020-2